3 Trends to Watch for Amazon Success in Q4 2020

It’s no secret that Amazon has been booming since the COVID outbreak. With the stock trading at over $3,000 USD for a single share, the company’s value has surged since March and industry analysts are expecting a massive holiday season for online shopping.

For independent store owners and marketers, nailing this holiday season is key to securing your place in the post-pandemic ecosystem. Here are three trends and tactics that ecommerce brands on Amazon should consider to make the most out of an uncertain holiday season.

#1) Get Ready for an October Prime Day

After a long period of uncertainty, Amazon announced recently that Prime Day will land on October 13th, 2020. As most Amazon sellers will recall, Amazon delayed Prime Day, which normally lands in July, due to the Coronavirus outbreak and the obvious pressures on Amazon’s logistics during this time.

This timing makes sense as Amazon is already expecting a big Black Friday / Cyber Monday season and by putting prime day in the middle of October, the shopping season will be extended and expectations will be for a long and promo-heavy season starting Prime Day and running until the end of the year.

Ecommerce brands should be ready with competitive pricing, PPC support and inventory and logistics preparedness. Don’t let this event catch you by surprise just because it was delayed – it’s happening soon!

#2) Bigger Demand, Lower Margins, Higher Costs

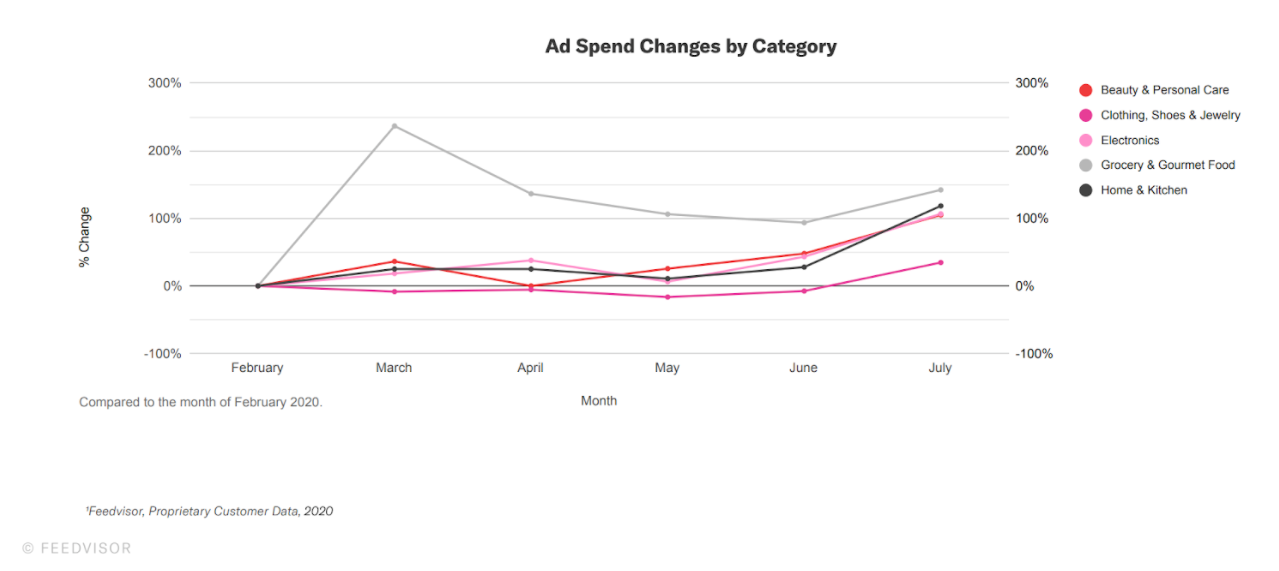

Simply put, there will be more buyers on Amazon this holiday season than ever before. As consumer attention moves, ad dollars move as well, with Amazon platform Feedvisor reporting huge growth in ad spend across multiple Amazon categories recently.

More spending will cause CPCs to rise and for many categories and will likely cause ACoS to rise. However, this will hopefully be offset by higher overall volume on Amazon to take advantage of. For brands, during Q4 you need to be watching your CPCs closely and planning for campaign strategies that can survive spikes in media cost.

#3) Leverage Amazon Attribution to See the Bigger Picture

Most brands selling on Amazon are also selling across other channels including their own ecommerce store, and are also investing in media spending on channels like Google Ads, Facebook Ads, and more.

These non-Amazon channels may frequently be contributing to Amazon sales, but if you’re not measuring this impact, this aspect of your media performance may be lost and you may make incorrect media planning decisions.

The Amazon Attribution tool solves at least part of this problem, by reporting to you how other traffic sources drive sales on Amazon. Implementing this tool is a key step for multi-channel retailers to get a correct overall view of media performance and make marketing decisions accordingly.