PPC: Latest Coronavirus Updates

Coronavirus PPC Update May 15th: Market Stability, Mother’s Day Success

In the second week of May, OpenMoves continue to perceive general optimism in the PPC landscape, with more advertisers seeing stability, ecommerce continuing to see success, and many clients seeing strong Mother’s Day performance. Though the market is still very weak in some sectors like travel, sports, and live entertainment, clients outside of these hard-hit sectors generally experience roughly stable results in May. Here are 3 trends we saw this week:

Ecommerce Success in Mother’s Day

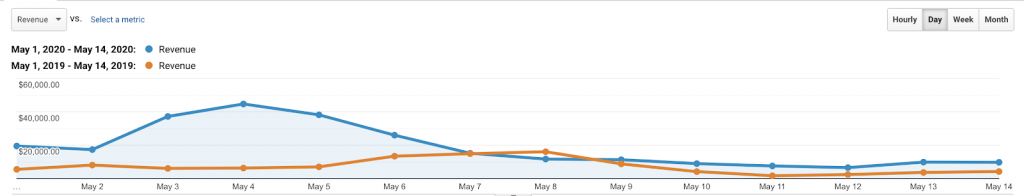

Mother’s Day was the 10th of May this year, meaning that most ecommerce advertisers had their last-ship days around the 7th and Mother’s Day shopping peaked around May 4th. We saw major YoY lift across ecommerce advertisers with relevant Mother’s Day products and promos as more consumers needed to buy gifts online. We can expect this trend to carry through Father’s Day in June as well.

Example Client: 150% YoY Growth in Mother’s Day Ecommerce

CPMs Stable Week/Week

We’re seeing market stability week over week, with normal seasonal and promotional trends impacting most advertisers. We expect incremental growth in media costs over time as the marketplace normalizes. Though the price of media should still be down YoY through Q2 and probably Q3 as well, we would not expect a big discount to persist into Q4.

| Client Sector |

CPM Jan + Feb |

CPM Last Week March |

CPM 1st Week May |

CPM 2nd Week May |

|

Food + Bev Advertiser |

$10.65 |

$6.88 |

$8.51 |

$9.23 |

|

Apparel Advertiser |

$10.33 |

$6.82 |

$7.58 |

$7.58 |

|

Education Advertiser |

$15.53 |

$15.53 |

$13.00 |

$12.76 |

Impact Varies Nationwide, Geotargeting Strategies Move Fast

As states across the country (and countries around the world) react differently to the virus, geotargeting strategies are in rapid flux. Some ecommerce advertisers are moving budget into states that remain closed, and pulling back on those that are reopening. Obviously, the inverse trend applies, with local advertisers cautiously rebooting in some parts of the country that are again open for business. Media buyers should be looking closely at fast-changing location performance reports to get the best media performance possible for clients.

Coronavirus PPC Update May 8th: Confidence Continues to Return to Digital Landscape

As we move into May, at OpenMoves we perceive the overall digital marketing and media buying landscape to continue to show signs of recovery and optimism.

We are seeing some advertisers that stopped digital media spend in March or April now reenter the market. We are also seeing that in some cases, budgets are growing as offline sales and marketing budgets are reallocated to digital. Finally, we’ve seen a number of major success stories especially in ecommerce as online sales thrive while retail stores are closed.

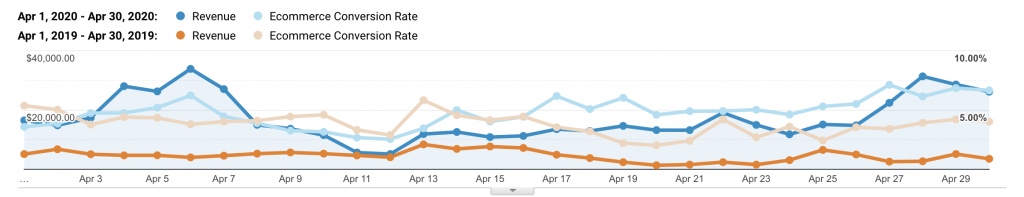

Ecommerce Thrives in April

It won’t surprise anyone that ecommerce has been thriving through Coronavirus, with many OpenMoves ecommerce clients raising budgets and launching new campaigns and new creatives to meet surging demand for online shopping. See below just two examples of OM clients that saw major ecommerce growth through April.

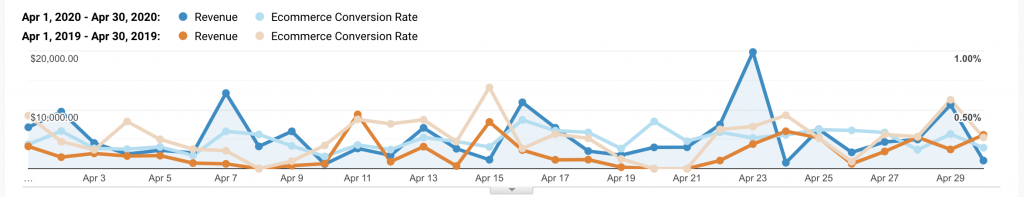

Fashion Ecommerce Grows 100% YoY in April 2020

Food + Beverage Ecommerce Grows 275% YoY in April 2020

Business Pivots, Budgets and Strategies Realign

We have seen within our client base and the broader industry remarkable speed in business transformation. Businesses are finding ways to transition from delivering products and services locally and in-person to online. For example, most of our local services clients like moving companies or home security firms are now offering online consultations and video quotes.

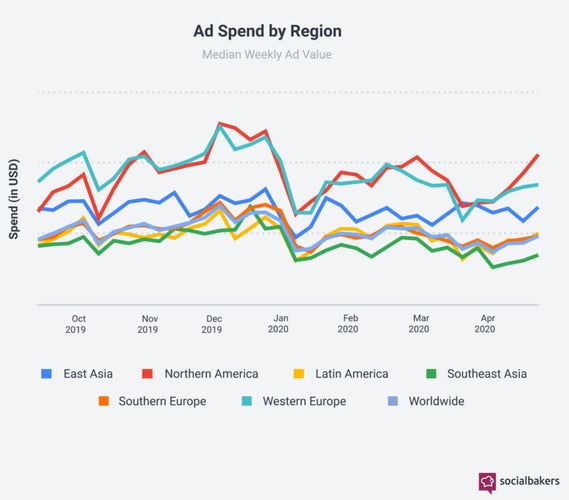

According to econsultancy, April saw a major uptick in social ads spending compared to March, as marketers and businesses reboot strategies and digital media remains the best option for reaching consumers.

Media is Still Cheap, but Starting to Normalize

Data on media costs for many clients shows a rational trend: the price of impressions and clicks hit the bottom of the market towards the end of March and early April. Now, price begin to rise again, though they are still discounted compared to the pre-Corona period.

Though many businesses have recovered, sectors like travel and hospitality will continue to be very limited in ad spend for months to come. For those businesses looking to get a discount in the media market, now is the time to act and launch. By Q4 it seems likely that the Corona discount will have largely disappeared.

|

CPM Jan / Feb |

CPM Last 7 Days |

CPM First Week May |

|

|

Food + Bev Advertiser |

$10.65 |

$6.88 |

$8.51 |

|

Apparel Advertiser |

$10.33 |

$6.82 |

$7.58 |

|

Education Advertiser |

$15.53 |

$11.40 |

$13.00 |

Coronavirus PPC Update April 20th: The Marketing Spend Pendulum Swings Back to PPC

As we get deeper into April and the Coronavirus impact begins to become more clear and government and business response becomes more organize, we are beginning to see some aspects of the marketing landscape stabilize. It has become more clear which business can continue to operate in these conditions and which cannot.

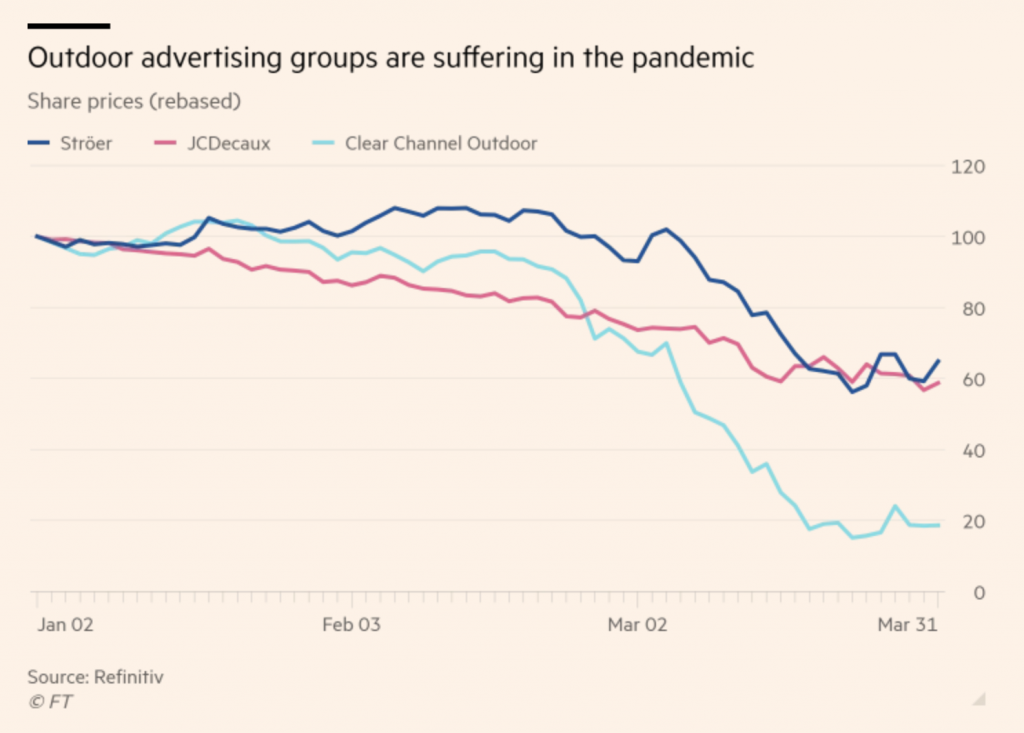

For OpenMoves, clients that operate in B2B lead generation and many ecommerce verticals, business is continuing on with at least modest stability. In fact, many brands with large and complex marketing strategies are now needing to rapidly operationalize actually increased digital media spending, to make up for declines in channels like out of home performance.

Thus, we are starting to see the marketing spend pendulum swing in the other direction: where earlier in the month businesses were stopping PPC spending out of caution or fear, now the opposite is happening with many brands needing to quickly scale digital media. Here’s some things we’re learning about this trend:

-

- MarTech Today Reports on Challenges of Rapid Digital Scale. The summary here is clear – in-person events and conferences are cancelled, out of home ads are not getting any reach, and the media needs to go online fast.

- The Financial Times Reports on OOH Coronavirus Impact. The FT reports the massive impact that Coronavirus is having on out of home advertising, especially ads in big cities and public transportation systems. Though some of this media budget may simply be cut, a portion will also be directed to digital spending.

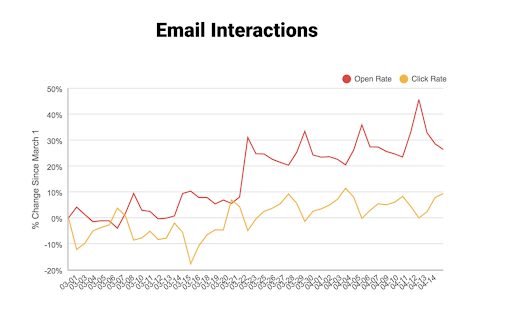

- Digital Opportunities Grow Fast During Lockdown. For advertisers with the ability to move quickly, there are new media and marketing opportunities opening up quickly. Econsultancy reports that retail email open rates are 40% higher now, while both YouTube and Facebook experience huge growth in usage, and reductions in media cost.

Overall, there’s no doubt that the Coronavirus and associated stopping of economic activity is having a huge negative impact on many sectors. However as the situation matures, businesses still able to operate are finding both opportunity and need to scale and optimize digital media campaigns to survive in the post-Corona landscape.

Coronavirus PPC Update April 3rd: $400 Million in Free Ads from Google + Facebook, $2 TN from the Government, and more

In another challenging week for public health and business success, we are seeing major investments from public and private sources to keep the economy running and digital media programs on track. Here’s a quick outline of what we learned and how things changed in the PPC industry this week:

- $2 Trillion Coronavirus Bill. Soon businesses and consumers across the country will begin seeing direct cash injections from the federal government. Many consumers will receive a direct deposit of $1,200 and many businesses will receive loans under very favorable conditions. Though economic strain is expected to increase through April, we also expect to start seeing this cash injection flow back into media spending.

- Facebook’s $100 Million Grants Program. Facebook has committed $100M to support small business through Corona. We’d expect this will largely come in credits for free advertising, which Facebook will likely want to deploy quickly to keep media campaigns running through April and May. Any small business should signup via the landing page linked above, though right now the exact details of the program are not clear.

- Google Offers $340 Million in Ad Credits. Like Facebook, Google will be offering advertisers free media spend, in an effort to help through Corona and keep media campaigns running. Eligible advertisers will start to see these ad credit notifications appear in Google Ads in the coming months.

- Cost of Media Continues to Fall. As expected, we continue to see the price of clicks and impressions falling on major media platforms. As usage volume grows and competition falls, media continues to be available at a discounted rate for businesses able to stay in the market. The table below shows examples of media price reductions we have seen for several clients / industries that have kept media plans generally stable through the Corona outbreak.

|

CPM Jan / Feb |

CPM Last 7 Days |

% Change |

|

|

Food + Bev Advertiser |

$10.65 |

$6.88 |

-35.4 % |

|

Apparel Advertiser |

$10.33 |

$6.82 |

-33.98 % |

|

Home Goods Advertiser |

$12.30 |

$10.75 |

-12.6 % |

|

Education Advertiser |

$15.53 |

$11.40 |

-26.59 % |

Coronavirus PPC Update March 27th: Data from Google, Bing and Facebook

In our previous updated, OpenMoves published early data findings on how Corona was impacting our clients. As the situation has evolved, we now have guidance from major PPC platforms on the impact and trends.

Google’s Coronavirus Guidance:

Google has not yet released specific PPC metric guidance on how Corona is impacting advertising cost, volume, competition or conversion rates. However Google’s COVID-19 search trends report provides great insight not only into Corona itself but all the related issues the virus is causing around the country including unemployment, stimulus questions, school closure questions, transactional product queries and more. Review this data to see where the market and public interest is trending.

<script type="text/javascript" src="https://ssl.gstatic.com/trends_nrtr/2152_RC02/embed_loader.js"></script> <script type="text/javascript"> trends.embed.renderWidget("US_cu_4Rjdh3ABAABMHM_en", "fe_list_6676c6b0-213f-434e-99b2-7079c300945c", {"guestPath":"https://trends.google.com:443/trends/embed/"}); </script>

Bing’s Coronavirus Guidance:

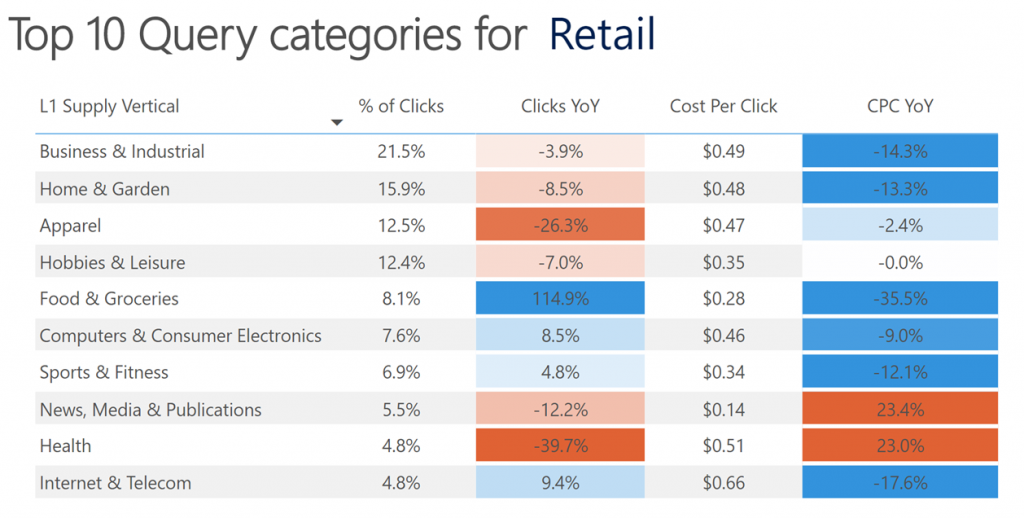

Microsoft and the Bing teams have also published a range of guidance on COVID-19 response for PPC. Our Bing reps shared with us specific industry metrics on PPC performance through Coronavirus as well – ask your Bing rep or OpenMoves account manager for the full report to see all the data. Below we can see a sample of this data – clear trends show “staples” searches see massive growth, and CPCs falling across many industries but rising significantly in healthcare.

Facebook’s Coronavirus Guidance:

- Facebook’s Small Business Grants Signup

- Facebook Coronavirus Business Hub

- Facebook Statement on Coronavirus

Perhaps more than any other platform, Facebook/Instagram is getting hammered by massive usage spikes as people communicate through the platform during emergencies and spend more time online. Though usage is spiking, ad investments across many industries is shrinking, which should lower CPM through the platform. However, CTR and engagement will also probably be lower.

Coronavirus PPC Update March 24th

3 Data Points on How the Media Buying Business is Performing During the Crisis

Last week, we posted an overview of how the Coronavirus outbreak is shaping PPC strategies across the country. As the crisis escalates and marketers and businesses begin to settle into a new reality, our team has compiled a new set of insights on how the media world is adapting to Corona.

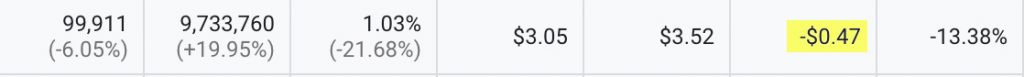

Theory Confirmed: Search CPCs are Dropping. Across a diverse set of PPC accounts, OpenMoves so far has observed a drop in overall average CPC of about 47 cents, or 13.4%, comparing the week of March 16th to the same time in February. This confirms our theory that media prices are at a discount now for advertisers with the time horizon and cash positions to sustain operations short-term.

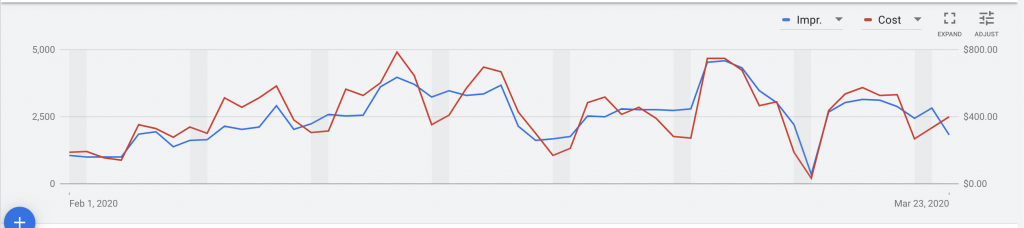

Even in Hard-Hit Categories, Consumers are Still Researching. Below is Google Ads impressions vs. cost chart for a business that found operations and sales go to near-zero during Corona, due to the nature of the business. Even at a time when consumers were not buying at all, demand in the industry in clicks and impressions was strong and stable. In other words, don’t expect that even in badly hit industries like travel and entertainment that consumer demand is gone – the buying intent has just been delayed.

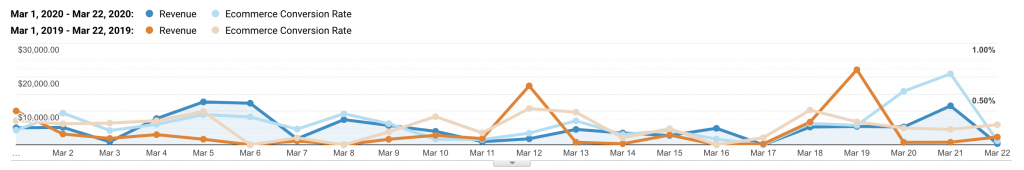

Lots of Ecommerce Players are Still Hot. Below is a Google Analytics revenue chart showing YoY sales for a luxury fashion ecommerce store. March is on track to be a strong month with over 40% in YoY revenue growth. This isn’t a business selling staples or medical supplies – just a normal fashion brand that adapted quickly to Corona messaging. People are still shopping and buying online in many ecommerce categories, especially with brands that have the right messaging and promotional strategy.